Altman Z Score for Private Companies

247 Access To More Than 130 Courses. Where x1 Liquidity Factor Working Capital Total Assets.

Bankruptcy Predictor For Private Companies Lsr

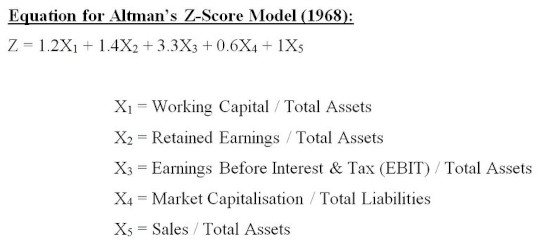

Original Z-Score formula for public manufacturing companies.

. Altman Z-score is useful for investors in deciding. Z-Score x10717 x20847 x33107 x40420 x50998. It can be used for predicting the bankruptcy and credit risk of any company.

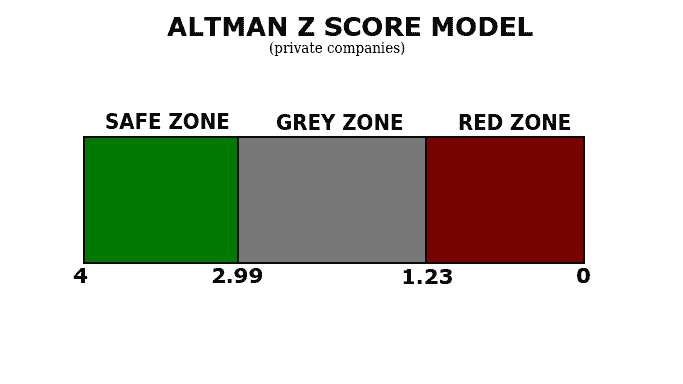

On the other hand private companies have a high chance of going bankrupt if the Z-Score is below 123. Z-SCORE BETWEEN 27 and 299 - On Alert. This zone is an area where one should exercise caution.

Benefits of Altman Z-score. Model B Z-Score for private general companies. This made Altman come up with a formula for these too.

Z-SCORE ABOVE 30 -The company is safe based on these financial figures only. Generally the Altman Z score below 18 denotes that the firm is under the chance of getting into bankruptcy. Z-SCORE BETWEEN 123 and 29 - On Alert.

The formula for Altman Z-Score is 12 working capital total assets 14 retained earnings total assets 33 earnings before interest and tax total assets 06 market value of. Altman Z-score was mainly designed for only public manufacturing firms with assets amounting to more than 1 million but later on modifications were made by Altman. Z-Score x1656 x2326 x3672 x4105.

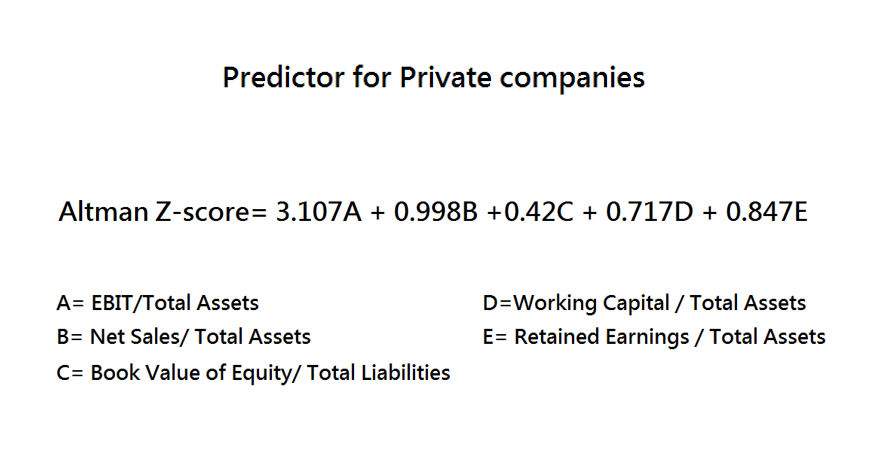

Z score x13107 x20998 x30420 x40717 x50847 x1 EBITTotal Assets. Altman then examined several common financial ratios based on data retrieved from annual financial reports. Z-SCORE BETWEEN 18 and 27 - Good chances of the company going bankrupt within 2 years of operations from the date of financial figures given.

He chose 66 publicly-traded manufacturing companies half of which had declared bankruptcy and half of which had not. Altman Z-Score Private Firms A x 3107 B x 0998 C x 0420 D x 0717 E x 0847 The Interpretation of Z Score. X2 Net salesTotal Assets.

In order to calculate Altman Z-Score for private companies follow the link. There was a need for predicting the possibilities of private companies filing bankruptcy. This model is particularly useful for businesses where the type of asset financing differs greatly across firms within the.

Z-Score Forecast Above 260 Bankruptcy is not likely 110 to 260 Bankruptcy can not be predicted-Gray area Below 110 Bankruptcy is likely Altman Z Score Formula. Z-Score 0717X1 0847X2 3107X3 0420X4 0998X5. For Calculating Z-Score consider the following formula.

The Altman Z-Score was published in 1968 by Edward Altman and measures a companys financial heatlth. Subscribe And Save More At CPA Self Study Online. Z-SCORE ABOVE 29 - The company is deemed Safe based on the given financial figures only.

Learn With CPA Self Study. Z 656 X1 326 X2 672 X3 105 X4. In depth view into FRAGDT0 Altman Z-Score explanation calculation historical data and more.

The Altman Z-Score model for a private company is. The classification results are identical to those of the 5-variable Z-Score model the new Z-Score model is. The formula for private companies is.

Altman Z Score 0717 x A 0847 x B 3107 x C 0420 x D 0998 x E Where. Z-Score Working Capital Total Assets x 12 Retained Earnings Total Assets x 14 Operating Earnings Total Assets x 33 Market Capitalization Total Liabilities x 06 Sales Total Assets x 10 In general the lower the score the higher the chance of bankruptcy. This is the grey zone and one should exercise Caution.

For Model 2 the sound Z-Score for private companies is above 29 indicating a low bankruptcy risk. The formula is as below. A Working Capital Total Assets.

Z-Score x112 x214 x333 x406 x50999. THE ALTMAN Z-SCORE FOR PRIVATE COMPANIES. For calculation use our Altman Z- Score Calculator.

This formula is helpful for investors to determine if they should consider buying a stock or selling some of the stocks they have. Z- Score for Private Companies. Sekur Private Data Altman Z-Score as of today August 20 2022 is 16517.

Original Z-Score 12X1 14X2 33X3 06X4 0999X5 2. It is considered as easy measure of corporate defaults. Ad Practical And Affordable CPE Courses For CPAs.

The financial ratios and their weights vary a bit to predict bankruptcy in private companies. On the other hand the firms with the Altman Z score above three are less likely to go bankrupt.

No comments for "Altman Z Score for Private Companies"

Post a Comment